Time Frames

- Understanding Multiple Time Frame Analysis

Understanding Multiple Time Frame Analysis

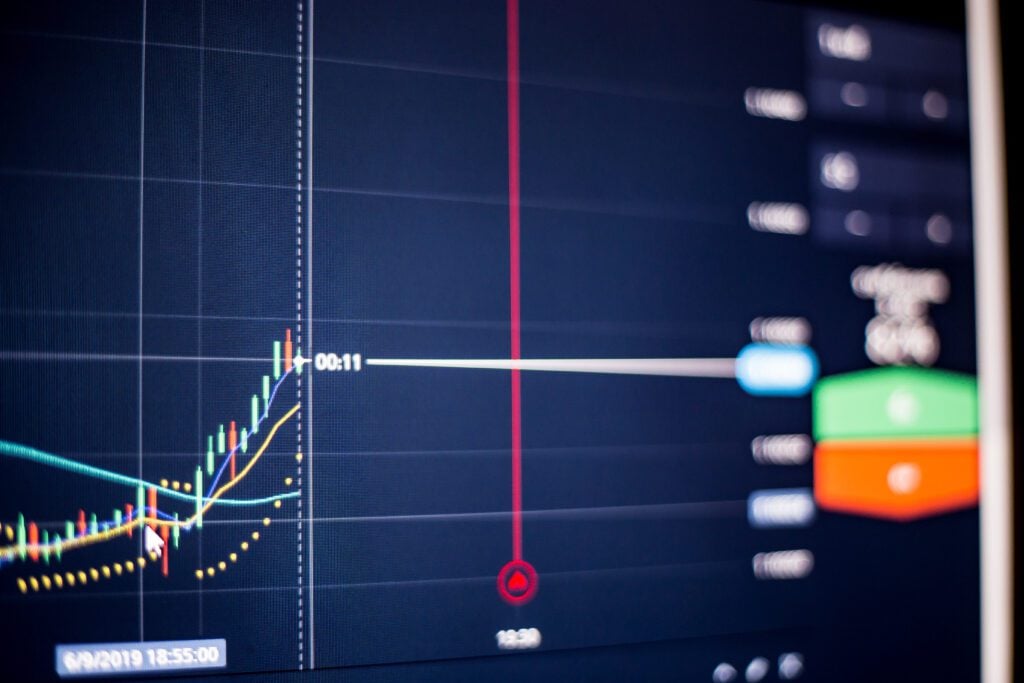

Multiple Time Frame Analysis involves studying the same currency pair across different timeframes—such as daily, 4-hour, and 1-hour charts. This approach provides a comprehensive view of the market’s overall trend and short-term price fluctuations.

Example 1: Identifying Trends

Suppose you’re considering a long trade based on the daily chart’s uptrend. Before executing the trade, switch to a lower timeframe, like the 4-hour chart. If the 4-hour timeframe aligns with the daily trend, it reinforces your conviction. Conversely, if the 4-hour chart suggests a different trend, you might reconsider your trade.

Example 2: Timing Entries

Imagine you’re planning to enter a trade based on the 1-hour chart’s technical indicators. Before proceeding, examine the 15-minute chart to fine-tune your entry. If the 15-minute chart shows an emerging reversal pattern that complements the 1-hour analysis, it could be an optimal entry point.

Example 3: Confirming Patterns

Suppose you’ve identified a bullish reversal pattern on the 4-hour chart. To validate its strength, switch to the daily chart. If the same pattern appears on the daily timeframe, it provides higher confirmation due to the larger timeframe’s significance.

Applying Your Knowledge:

As you analyze forex charts, adopt a multi-timeframe perspective to validate your observations. Remember that while larger timeframes offer broader trends, smaller timeframes provide finer details for entries and exits.

What’s Next?

Congratulations on completing Lesson 4 of 5! But don’t stop now—there’s so much more to learn.